All Categories

Featured

Table of Contents

The technique has its very own advantages, however it also has concerns with high costs, complexity, and more, leading to it being considered as a rip-off by some. Infinite financial is not the most effective plan if you require only the investment part. The limitless banking principle focuses on making use of whole life insurance policy plans as a financial device.

A PUAR allows you to "overfund" your insurance plan right approximately line of it coming to be a Customized Endowment Contract (MEC). When you make use of a PUAR, you rapidly enhance your cash money worth (and your fatality advantage), thus boosting the power of your "bank". Better, the even more cash money value you have, the better your passion and returns payments from your insurance policy firm will be.

With the surge of TikTok as an information-sharing platform, economic suggestions and methods have actually located an unique method of dispersing. One such approach that has been making the rounds is the unlimited banking principle, or IBC for short, amassing endorsements from celebrities like rap artist Waka Flocka Fire - Policy loans. While the method is currently preferred, its roots trace back to the 1980s when economic expert Nelson Nash introduced it to the globe.

How does Wealth Building With Infinite Banking compare to traditional investment strategies?

Within these plans, the money value expands based upon a price set by the insurance provider. When a considerable money value collects, policyholders can obtain a money worth financing. These fundings vary from conventional ones, with life insurance policy offering as security, meaning one might shed their insurance coverage if loaning exceedingly without appropriate cash value to support the insurance expenses.

And while the appeal of these plans is noticeable, there are innate constraints and threats, necessitating diligent cash value monitoring. The strategy's authenticity isn't black and white. For high-net-worth people or local business owner, particularly those using strategies like company-owned life insurance coverage (COLI), the benefits of tax obligation breaks and compound development could be appealing.

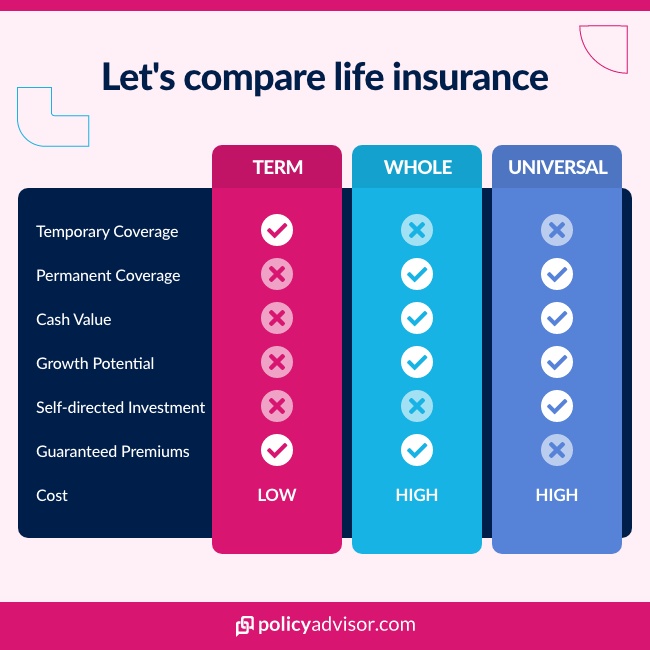

The allure of infinite financial doesn't negate its obstacles: Price: The fundamental requirement, an irreversible life insurance policy plan, is costlier than its term counterparts. Qualification: Not everyone gets approved for entire life insurance policy due to extensive underwriting procedures that can omit those with certain wellness or way of life problems. Complexity and danger: The detailed nature of IBC, combined with its dangers, might discourage several, particularly when easier and less risky choices are available.

Is Privatized Banking System a good strategy for generational wealth?

Designating around 10% of your monthly revenue to the plan is simply not viable for most individuals. Utilizing life insurance policy as a financial investment and liquidity source requires technique and tracking of plan money value. Speak with an economic advisor to determine if unlimited banking lines up with your priorities. Part of what you review below is simply a reiteration of what has actually currently been said over.

So before you obtain right into a situation you're not prepared for, know the following initially: Although the principle is commonly sold therefore, you're not actually taking a car loan from on your own. If that were the instance, you would not have to settle it. Rather, you're obtaining from the insurer and have to repay it with interest.

Some social media posts advise utilizing cash worth from entire life insurance coverage to pay down credit rating card debt. When you pay back the finance, a section of that rate of interest goes to the insurance coverage business.

What type of insurance policies work best with Bank On Yourself?

For the first several years, you'll be paying off the commission. This makes it exceptionally hard for your plan to gather worth during this time around. Entire life insurance policy prices 5 to 15 times a lot more than term insurance coverage. Most individuals simply can't manage it. So, unless you can pay for to pay a couple of to a number of hundred dollars for the following decade or even more, IBC won't help you.

If you need life insurance policy, below are some useful ideas to think about: Take into consideration term life insurance coverage. Make sure to go shopping about for the finest rate.

Is Infinite Banking a good strategy for generational wealth?

Think of never ever needing to worry concerning bank car loans or high rates of interest once again. What happens if you could obtain money on your terms and construct riches concurrently? That's the power of infinite banking life insurance policy. By leveraging the money value of entire life insurance policy IUL plans, you can grow your riches and borrow cash without depending on typical financial institutions.

There's no set finance term, and you have the freedom to decide on the repayment schedule, which can be as leisurely as settling the loan at the time of death. This versatility includes the maintenance of the car loans, where you can go with interest-only settlements, keeping the lending equilibrium flat and manageable.

How do I track my growth with Infinite Banking Cash Flow?

Holding cash in an IUL dealt with account being attributed passion can often be better than holding the cash on deposit at a bank.: You've always imagined opening your own bakeshop. You can obtain from your IUL policy to cover the initial costs of renting a space, purchasing tools, and hiring personnel.

Individual car loans can be gotten from typical banks and credit score unions. Borrowing cash on a credit history card is usually very costly with yearly percent prices of passion (APR) often reaching 20% to 30% or even more a year.

Table of Contents

Latest Posts

Nelson Nash Bank On Yourself

Be My Own Banker

How To Create Your Own Bank

More

Latest Posts

Nelson Nash Bank On Yourself

Be My Own Banker

How To Create Your Own Bank