All Categories

Featured

Table of Contents

You then get the vehicle with money. Private banking strategies. The debate made in the LIFE180 video clip is that you never obtain anywhere with a sinking fund. You diminish the fund when you pay cash money for the automobile and replenish the sinking fund only to the previous degree. That is a massive misconception of the sinking fund! The cash in a sinking fund gains passion.

That is exactly how you stay on par with inflation. The sinking fund is constantly expanding via rate of interest from the conserving account or from your cars and truck repayments to your lorry sinking fund. It additionally takes place to be what limitless banking conveniently fails to remember for the sinking fund and has outstanding recall when related to their life insurance policy item.

Well, I'm not calling anyone a liar. I am calling the math into concern. In the video clip we hear our initial ecstatic brag. See the $22,097 highlighted? That, we are informed, is the boost in our money value in year two. But let's dig a little bit below. The actual boast should be that you contributed $220,000 to the infinite financial plan and still just have a Money Worth of $207,728, a loss of $12,272 approximately this factor

The $22,097 highlighted in the video comes from the "Non-Guaranteed" columns. The "Surefire" quantity is much less. Aaaaaand. You still have a loss no matter what column of the projection you use. Of program you can "obtain" several of your very own cash if you desire. More on that particular later on. Life insurance loans. We need to chat regarding.

Now we transform to the longer term rate of return with unlimited financial. Prior to we disclose truth long-term rate of return in the entire life policy projection of a promoter of unlimited banking, let's ponder the concept of linking a lot cash up in what in the video is called an interest-bearing account.

The only way to turn this into a win is to utilize malfunctioning math. First, review the future value calculator listed below.

What is the minimum commitment for Bank On Yourself?

The idea is to get you to think you can make money accurate obtained from your unlimited banking account while all at once gathering a revenue on various other financial investments with the exact same money. Which leads us to the next deadly defect. When you take a funding from your whole life insurance policy plan what actually occurred? The cash value is a legal guarantee.

The cash value belongs to the insurer. It doesn't belong to you. The "appropriately structured whole life plan" bandied around by sellers of boundless financial is truly just a life insurance policy firm that is owned by policyholders and pays a returns. The only reason they pay a reward (the passion your cash worth earns while borrowed out) is because they overcharged you for the life insurance coverage.

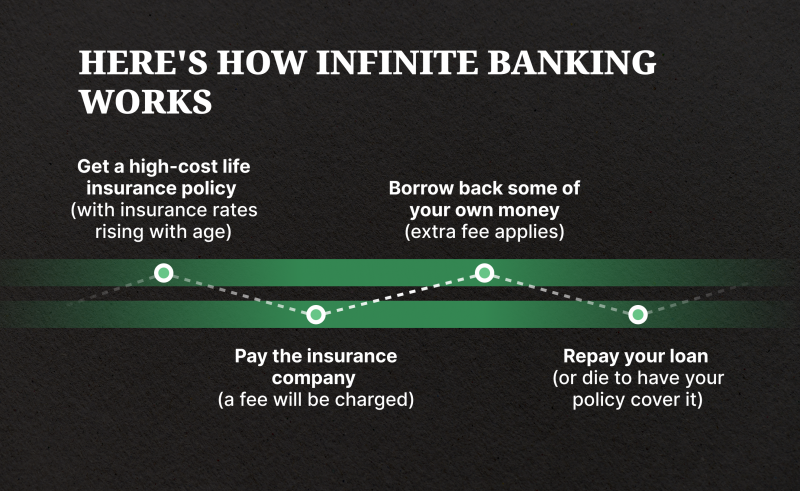

Each insurance provider is various so my instance is not a perfect match to all "effectively structured" unlimited banking instances. It works like this. When you obtain a funding of "your" cash worth you pay passion. THIS IS AN ADDITIONAL FINANCING OF YOUR UNLIMITED FINANCIAL ACCOUNT AND NOT DISCLOSED IN THE IMAGE! Envision if they would have added these total up to their sinking fund instance.

Is Cash Flow Banking a better option than saving accounts?

Even if the insurance provider credited your money worth for 100% of the interest you are paying on the funding, you are still not getting a complimentary ride. Cash value leveraging. YOU are paying for the passion attributed to your money worth for the amounts loaned out! Yes, each insurer entire life policy "effectively structured" for boundless financial will certainly vary

Here is one nightmare boundless banking supporters never desire to discuss. When you pass away, what occurs with your entire life insurance policy policy? Your beneficiaries obtain the fatality advantage, as guaranteed in the contract in between you and the insurance provider. Wonderful! What takes place to the money worth? The insurance business maintains it! Keep in mind when I stated the financing from your money value originates from the insurer basic fund? Well, that is since the cash money worth belongs to the insurance business.

Life insurance companies and insurance coverage agents like the idea and have ample factor to be blind to the deadly problems. In the end there are just a couple of reasons for making use of long-term life insurance coverage and infinite banking is not one of them, no issue how "effectively" you structure the policy.

The following strategy is a variant of this strategy where no financial debt is needed. Below is exactly how this method works: You will certainly need a mortgage and line of credit rating.

Is Infinite Banking Cash Flow a better option than saving accounts?

Your normal home mortgage is now paid for a bit more than it would certainly have been. As opposed to keeping more than a token quantity in your bank account to pay expenses you will go down the money right into the LOC. You currently pay no interest since that quantity is no more obtained.

If your LOC has a greater rate of interest rate than your home mortgage this technique runs into issues. If your mortgage has a greater rate you can still utilize this technique as long as the LOC interest rate is similar or reduced than your home mortgage rate of interest rate.

The any individual can make use of (Infinite Banking for financial freedom). Limitless banking, as advertised by insurance agents, is developed as a large interest-bearing account you can borrow from. Your original cash maintains gaining also when obtained bent on you while the obtained funds are invested in various other earnings generating possessions, the supposed double dip. As we saw above, the insurance policy business is not the warm, unclear entity distributing totally free money.

If you get rid of the insurance coverage business and invest the same monies you will certainly have much more due to the fact that you do not have middlemen to pay. And the rate of interest price paid is possibly higher, depending on current passion prices.

What are the tax advantages of Leverage Life Insurance?

You can withdraw your cash any time. You can constantly call it borrowing your very own money if you want. The exact same principle collaborates with money markets accounts at financial institutions (financial institutions or lending institution). Right here is the magic of unlimited financial. When you obtain your own money you also pay on your own a passion rate.

Latest Posts

Infinite Banking Concept Example

Personal Banking Concept

Whole Life Banking